Where AI Meets ROI: Why Financial Service Teams Are Turning to Agentforce

Imagine if every financial adviser walked into a client meeting already prepared. No data wrangling. No juggling systems. Just meaningful conversations from the outset. That’s what Agentforce makes possible, and for today’s financial services teams, it couldn’t come at a better time.

The Pressure on Financial Services

Financial teams are under strain. Customer expectations are rising, compliance demands are increasing, and adviser numbers continue to shrink. Since 2019, Australia has lost 38% of its registered financial advisers, with little sign of that trend reversing.

At ProQuest, we work closely with banks, insurers, fintechs, and wealth firms across Australia. We’ve seen the mounting pressure. Teams are overloaded. Inboxes are overflowing. Traditional ways of working are no longer enough.

Something has to give. And for many, the turning point is Agentforce.

Meet Agentforce

Agentforce is Salesforce’s AI-powered virtual assistant that helps your team spend less time on admin and more time adding value. It works within your existing Salesforce setup to support customer-facing teams with tasks like lead triage, client summary preparation, query responses, and workflow automation.

Rather than replacing your people, Agentforce acts like a trusted assistant - taking care of repetitive tasks, reducing context-switching, and helping everyone move faster and smarter.

Let’s look at a few real-world examples of how Agentforce is delivering results for financial services teams.

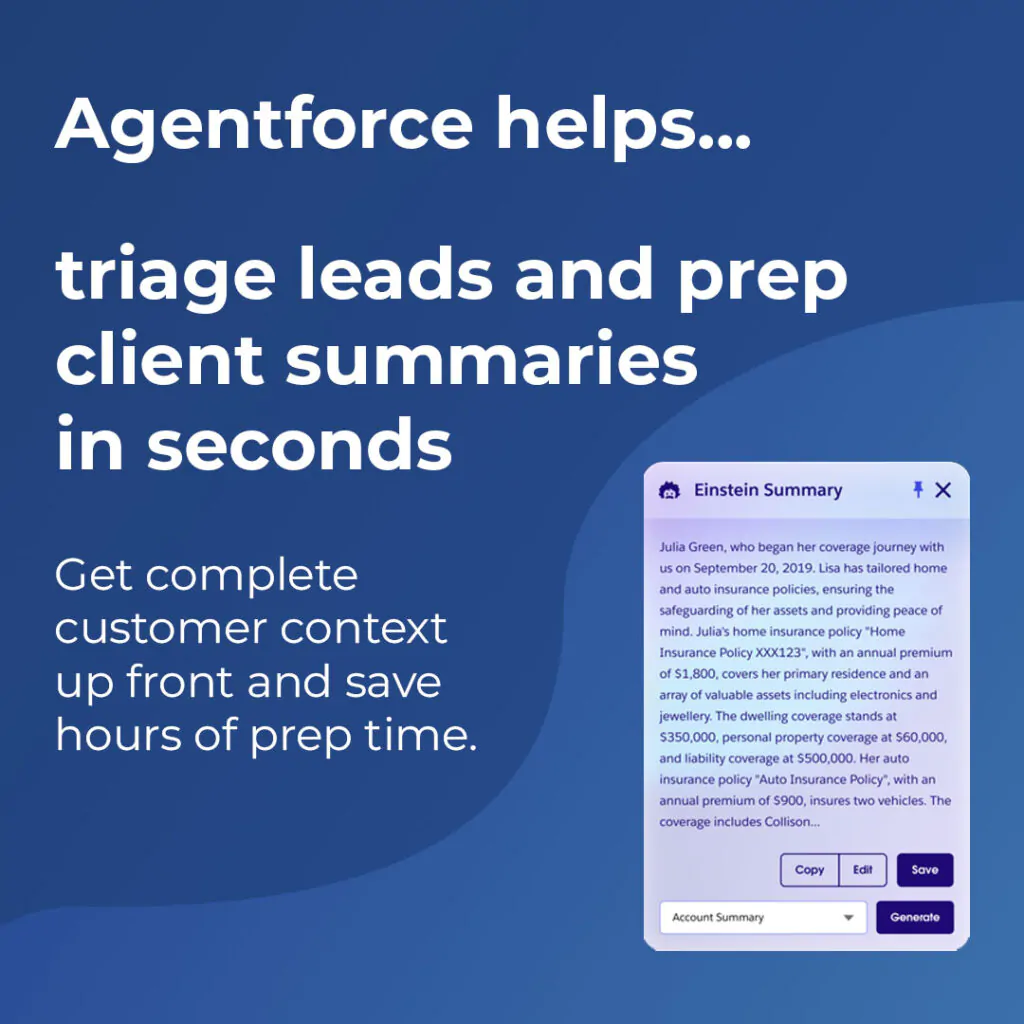

1. Preparing for Client Meetings in Minutes

On average, advisers spend almost half of their client-facing time preparing for meetings. That includes searching across systems for account details, claims history, and financial products- often just to be ready for a single conversation.

Agentforce simplifies that by automatically gathering and summarising relevant client data into a single, easy-to-digest view. Everything your team needs is available in one place, directly inside Salesforce.

This means less time preparing, and more time engaging. It turns meeting prep from a 12-hour weekly drain into a quick, high-impact activity.

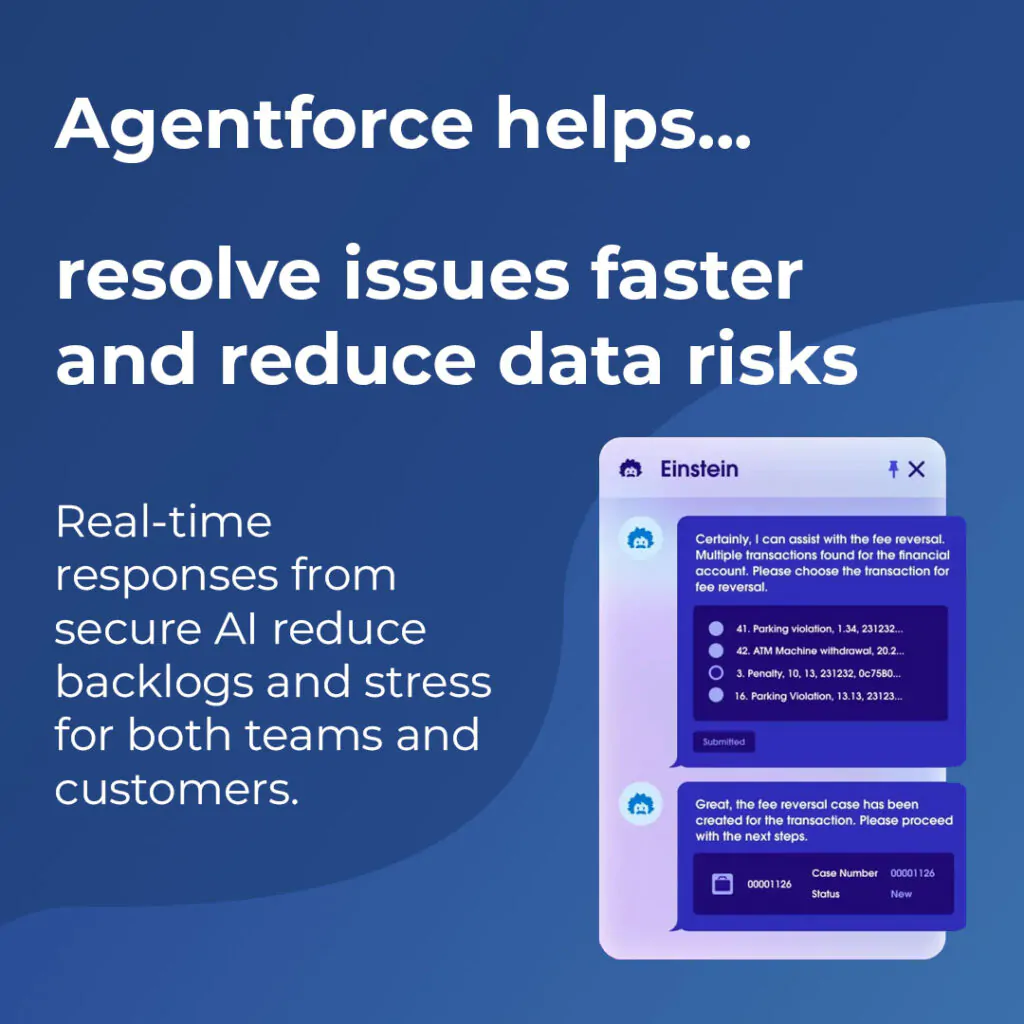

2. Faster Issue Resolution with Greater Confidence

When customers contact a bank or insurer for support, they want answers fast - and they don’t want to repeat themselves.

Agentforce helps resolve common issues quickly by retrieving the relevant account or transaction data and identifying inconsistencies in real time. Whether it’s a disputed charge, a balance check, or a missing payment, it delivers the right information immediately, so your team can respond confidently.

Importantly, all of this happens securely within Salesforce. Agentforce ensures personal data is accessed only where needed, keeping information safe and reducing the risks that come with manual handling.

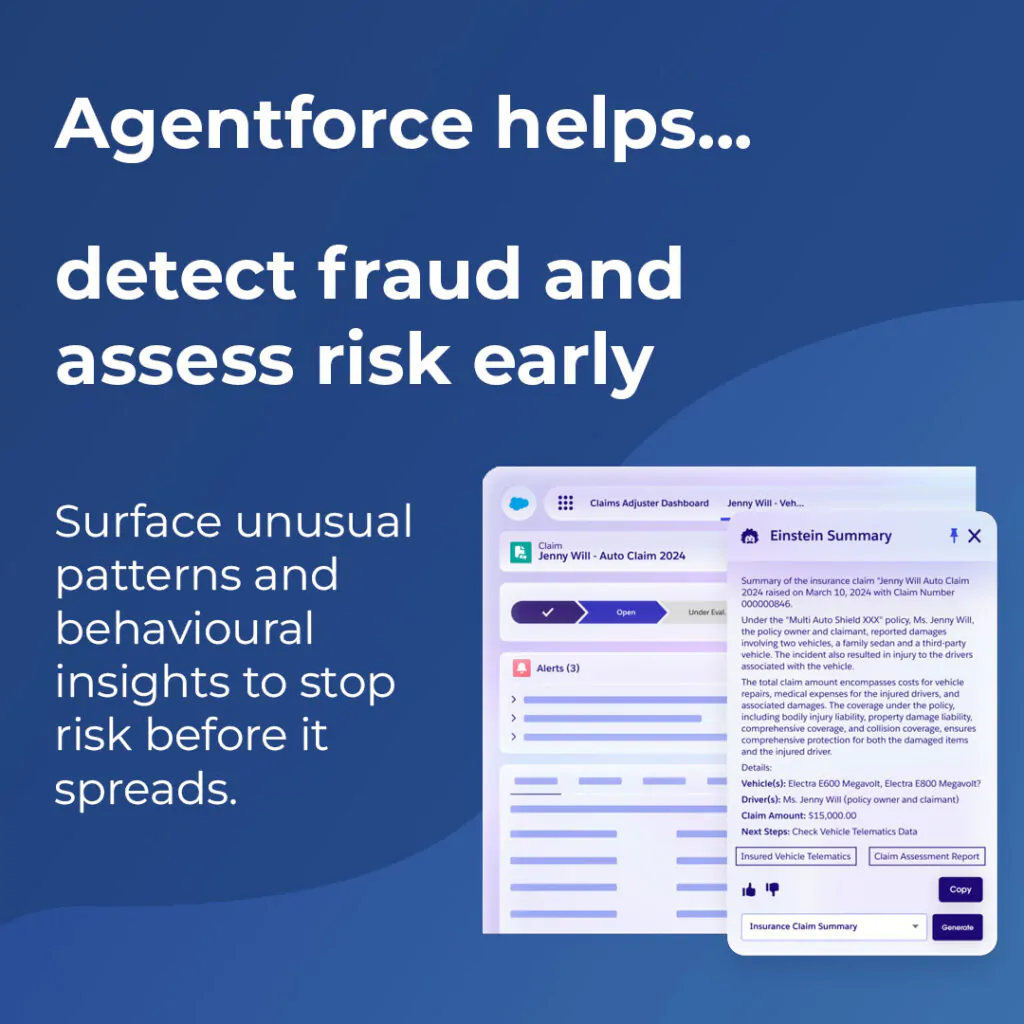

3. Proactive Risk and Fraud Detection

Managing risk is core to any financial services team. But identifying it early (and accurately) can be a challenge.

Agentforce helps by analysing large volumes of behavioural and transactional data to flag unusual patterns or potential fraud. It can also support credit decisions by spotting early indicators of risk, even for customers with limited financial history.

The result is faster, smarter decision-making without sacrificing compliance. And because it all happens within your Salesforce environment, data governance remains tight and auditable.

Client Story: Expert Wealth

Expert Wealth, a financial planning firm, partnered with ProQuest and Salesforce to streamline its onboarding experience. By introducing an AI assistant named Sully, they were able to qualify leads and schedule meetings without manual intervention.

The outcome?

🚀 30% faster onboarding

📉 50% fewer steps required to book a meeting

Agentforce helped remove friction from the process, giving advisers more time for strategic conversations - and less time chasing admin.

"We started using Agentforce for increased productivity but also to deliver additional value to the client that typically we wouldn't have been able to do."

Clinton Hatcher

Digital Innovation Manager, Expert Wealth

Ready to Do More with Less?

The demands on financial services teams aren’t easing up. But with tools like Agentforce, it’s possible to deliver faster service, stronger engagement, and better decisions, without overwhelming your team.

ProQuest helps financial organisations implement Agentforce in a way that fits their systems, people, and priorities. We don’t just switch it on - we make it work for you.

If you're ready to see what AI can really do for your team, let’s have a conversation.

Very interesting article! I presume smaller FINS companies will jump on AI earlier than larger groups and will have a unique opportunity to disrupt their industry.