Customer Expectations: Financial Services Gamechanger for 2024

More than ever, Financial Services companies are facing unprecedented levels of competition and customer expectations have never been so high. With frustrations over long wait times, rigid processes, and poor service, staying relevant means adapting to modern needs. A new era of modern digital experiences is emerging in this industry. At ProQuest Consulting we help our customers harness this opportunity to become market leaders. In this article, we will break down the key areas where companies can innovate to stay at the top of their game.

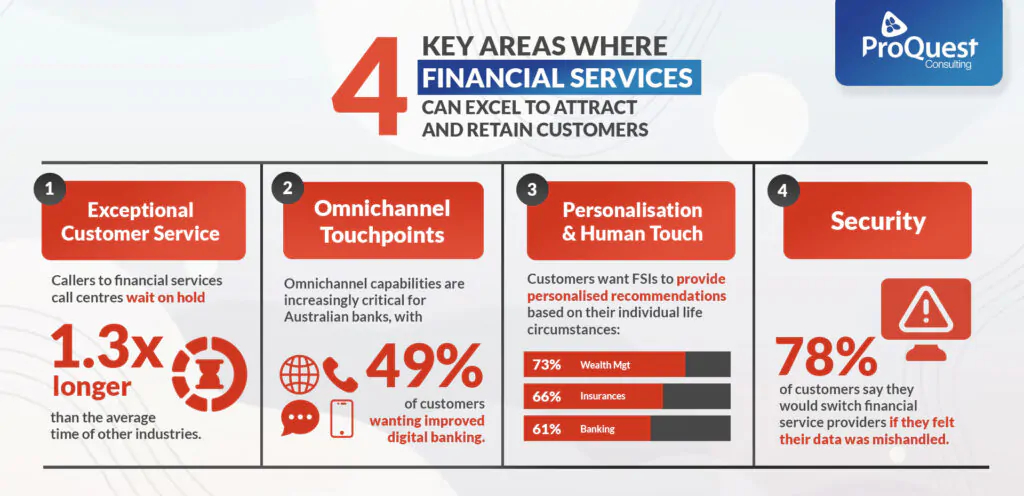

Four key areas where Financial Services companies can stand out:

1. Exceptional Customer Service

Bad experiences can be deal-breakers— 39% of customers switch their FSIs after just one poor interaction with customer service. Wait on hold is 1.3x longer for Financial Services companies than the average time of other industries.

Quick responses, accurate solutions, and a little empathy can make a world of difference. Customers want fast, effective help without needing to call back or be transferred around. And it’s not just about speed—people want to feel heard and valued, which fosters trust and loyalty.

2. Omnichannel Touchpoints

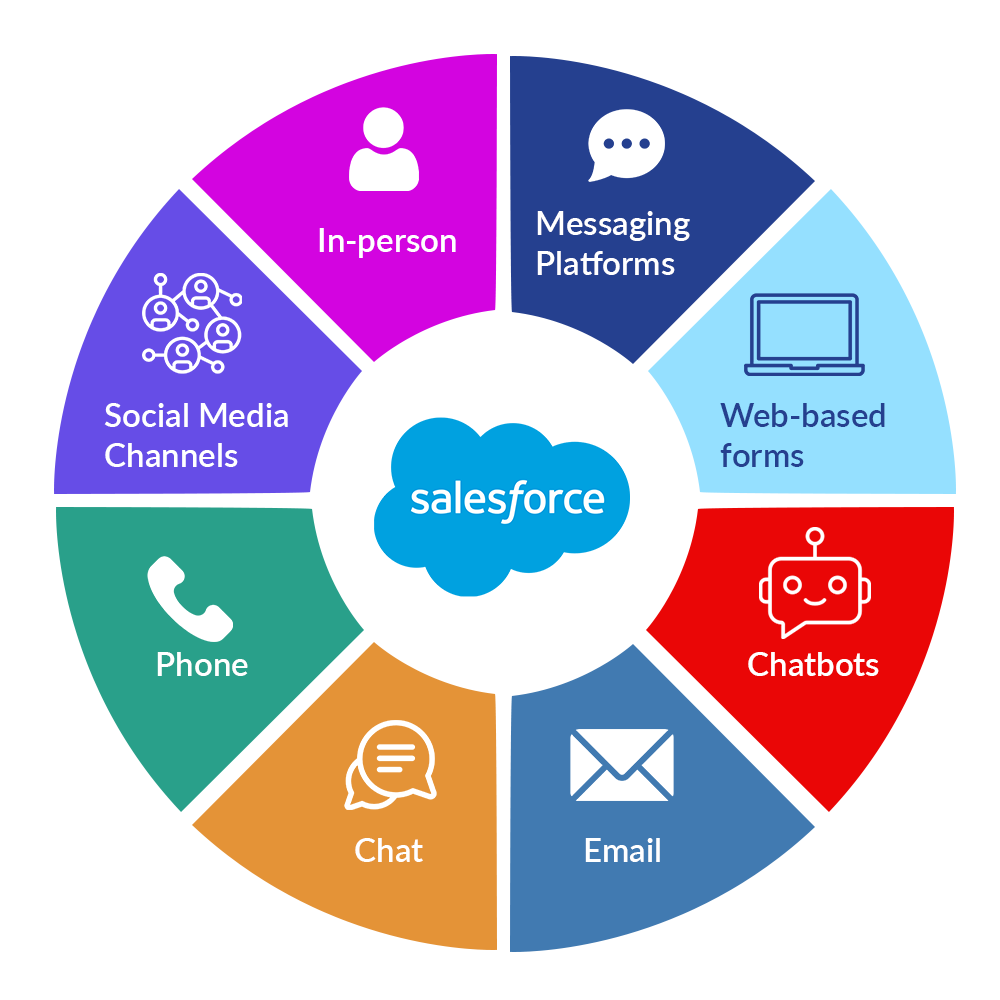

Today’s customers expect a seamless experience across all platforms, whether they’re calling, emailing, using live chat, or visiting a branch. Even with digital banking on the rise, 45% of people still use branches monthly, so both digital and traditional channels are important.

Omnichannel capabilities and personalisation are increasingly critical for Australian banks, with 49% of customers wanting improved digital banking, especially regarding customer service.

Financial services should ensure consistency across these touchpoints and make sure customers don’t have to repeat themselves when switching between channels.

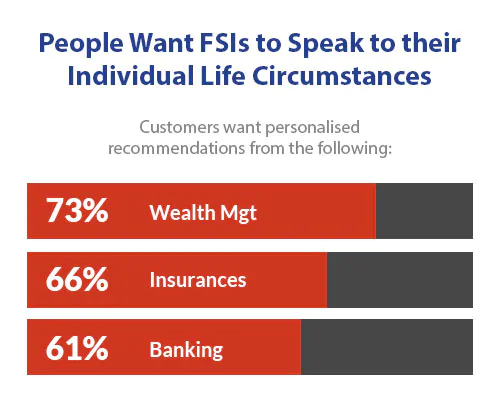

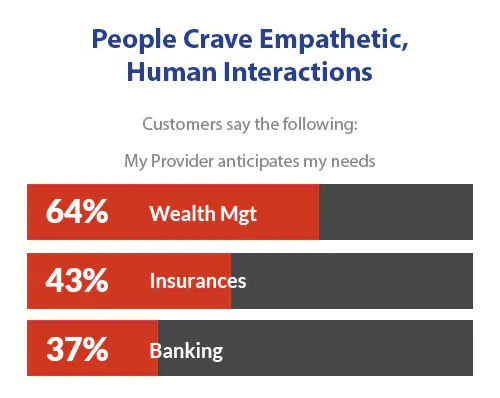

3. Personalisation and Human Touch

People want more than just basic service—they want personalised interactions that show you know who they are. Gone are the days when they are only looking for the cheapest options; they seek value in services that give them enhanced experiences

*The Connected Financial Services Report

While digital tools like chatbots are useful, they can feel robotic. Thanks to recent breakthroughs in the AI space, Autonomous Agents can bridge that gap. GenAI is now able to deliver human-like conversations across multiple channels, answer complex enquiries and even take actions without the need for human intervention. With this new type of technological capabilities, customer service agents can focus on proactively reaching out to customers during tough times, and offering relevant advice or services, which can go a long way in building trust and loyalty.

4. Security

With increasing cyber threats, security is more important than ever. Trust and loyalty can be fragile—78% of customers say they would switch financial service providers if they felt their data was mishandled.

Financial institutions must prioritise data protection with advanced encryption and regular audits, while also educating customers on how to protect themselves from scams. When things go wrong, customers expect their banks to act quickly and provide clear guidance.

Use Case: PenFed Credit Union

PenFed Credit Union, one of the largest credit unions in the U.S. with 2.9 million members, saw impressive results after enhancing their customer service. They achieved a 31% membership growth, resolved 20% of cases on the first contact, and reduced call wait times to under 60 seconds.

With self-service options powered by Salesforce Experience Cloud, they’ve helped over 11,000 members access financial support like loan deferment instantly. Members now enjoy faster help, choosing whichever support channel suits them best.

Don't wait until it's too late to make the necessary changes. Customer loyalty is fragile, and to stay competitive and retain your clientele, it's essential to step up your game. Ensure exceptional customer service, seamless omnichannel experiences, personalised interactions, and robust security measures. Work with ProQuest Consulting today.